The context of his remarks are important - the rapidly escalating federal budget deficits present a clear and present danger to the economic health and welfare of society. This deficits generate an increasing burden on current and future generations in the form of increasing debt costs. I have required my students this semester to read America the Broke: How the Reckless Spending of The White House and Congress are Bankrupting Our Country and Destroying Our Children's Future. This 2004 book by Gerald Swanson of the University of Arizona is a polemic, but an important and early view of the context that Boyes uses to analyze the scheme to increase taxes . . . eventually on all.

“One day soon, our government will suddenly run out of cash, unable to meet its payments, leaving the United States as bankrupt as any banana republic. We are far more vulnerable than most Americans realize. . . With a debt of $7.3 trillion, if interest rates were to hit the levels we saw 20 years ago, it would take every nickel collected in income taxes just to pay the interest on our existing debt. There would be no money left for defense, or homeland security, or education, or Social Security.

This scenario is hardly fiction. That the United States of America can literally go broke is no longer a fantasy but likelihood—unless we stop the train now speeding us to Armageddon. If we do not get our financial house in order, and soon, our great nation will collapse under the weight of its financial obligations.

I believe we can prevent the catastrophe. But time is short. In the final reckoning, it’s up to us to do what’s needed to save America’s future.”—from America the Broke

The dirty little secret that neither George W. Bush nor Congress are willing to confront—that America’s reckless spending, disastrous deficits, and exploding debt are speeding our great nation to financial ruin.

Imagine a world in which you lose your job because your company goes under, your retirement money disappears, the value of your home tumbles overnight, your bank stops allowing cash withdrawals, and your ATM card is canceled. The price of groceries has risen so fast that you don’t have the money to pay for them at the check-out counter . . . and the country is bankrupt.

That is exactly the future that economist Gerald J. Swanson sees America hurtling toward—unless we rein in our country’s reckless spending. In America the Broke, Swanson, coauthor of the runaway New York Times bestseller Bankruptcy 1995, argues that the United States is on the brink of financial collapse.

Back to the issue of taxes. There are only two alternatives to the current fiscal disaster - reducing spending and/or increasing taxes.

I would favor tax reform rather than increasing marginal rates on any bracket of taxpayer. This reform would include:

1. Elimination of business subsidy. Boyes and I have blogged here analyzing the perverse incentives and consequences of subsidy to the business sector. Elimination of these subsidies would accomplish two important goals - increasing revenue to the state to reduce the deficit and improve economic performance by increasing efficiency.

2. Elimination of individual subsidy - for example the deduction for home interest expense. Elimination of these subsidies would accomplish two important goals - increasing revenue to the state to reduce the deficit and improve economic performance by revealing the cost of consumption.

3. Flat tax for individual tax payers.

4. Elimination of the corporate income tax.

5. Elimination of the ceiling on social security and medicare payroll taxes.

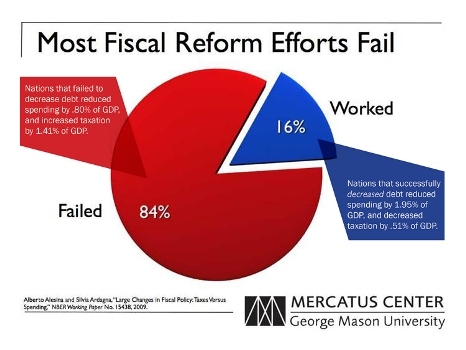

That said, the Mercatus Center agrees with Milton Friedman that the most likely path toward successful fiscal balance is spending cuts rather than tax increases (reform?)

Mitchell shows that a number of other researchers have confirmed that reforms that focus on spending cuts are far more likely to be successful than those that focus on revenue increases. He also demonstrates the consequences of failing to heed history’s lessons.

http://mercatus.org/publication/most-fiscal-reform-efforts-fail

No comments:

Post a Comment