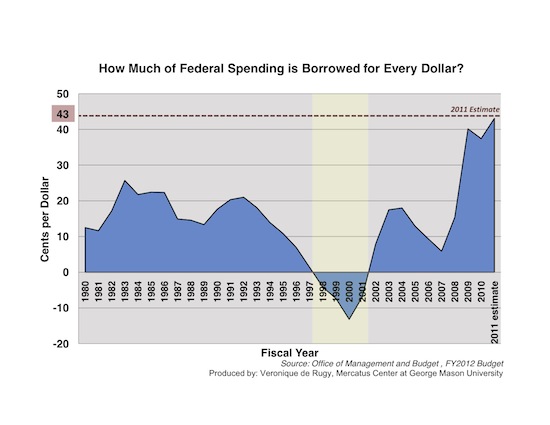

According to the Internal Revenue Service, in 2008, those in the top 1 percent of the income distribution, with incomes over $380,000, had an effective tax rate of 23.3 percent. In 1986, a year when the real gross domestic product grew a healthy 3.5 percent, their effective tax rate was 33.1 percent. The argument for increasing taxes on the rich states that if this group were still paying 33.1 percent, federal revenue would have been more than $166 billion higher in 2008 alone. That would be enough to reduce the budget deficit by about 10 percent this year. If the top 1 percent of taxpayers had continued to pay the same effective tax rate they paid in 1986 every year from 1987 to 2008, the federal debt today would be $1.7 trillion lower.

Warren Buffett is one of the strongest proponents for higher taxes on the “mega” rich. If those 400 mega-rich people could be taxed on their earnings at the top 35 per cent income tax rate, it would raise an extra $12bn in taxes. If they could be made to pay 50 per cent that would raise an extra $26bn. Sounds good doesn’t it? But before jumping on the bandwagon we need to inquire about a few things. . What is the effect of such a tax? Will the mega rich or just rich be able to alter behavior so that they don’t pay the higher tax?

If Buffett and other billionaires do not think they are paying their fair share toward government programs, they can voluntarily send the government an additional check. So why would they favor raising taxes on those who make as little as $250,000 a year, an amount that is less than one one-hundred-thousandth of Buffett's total wealth?

Perhaps the mega-rich know that raising tax rates on individuals with incomes of more than $200,000, or married couples with incomes above $250,000, may have no affect at all on the amount the mega-rich pay in taxes. Families with a billion dollars of wealth do not have to earn another dollar of income to maintain their lifestyles. They could hold all of their assets in cash and still be able to spend $20 million a year for the next 50 years on whatever they please. For the truly rich, engaging in economic activity and paying taxes is voluntary in every sense of the word.

But a counter to Buffett’s proposal is that although a billionaire's lifestyle would be unaffected by forgoing all income, the rest of us would lose the value that billionaire's contributions would have made to the economic life of the community. We would never know what start-ups died for lack of venture capital or what businesses failed because of the absence of management skills. Buffett's contribution to the wealth of the American economy through the investments he has made with the assets of his company, Berkshire Hathaway, far outstrip the dollar value of his sizable fortune.

One argument against an increase in taxes on the rich is that it would penalize small business and therefore hurt employment and economic growth. The basis for this claim comes from Internal Revenue Service data. The U.S. Treasury Department found that many of the wealthiest tax filers report some type of non-wage income, such as income from a sole proprietorship, a partnership or an S corporation. The Treasury Department estimated that 75 percent of tax payers in the top bracket reported this type of income. According to IRS data, fully 48% of the net income of sole proprietorships, partnerships, and S corporations reported on tax returns went to households with incomes above $200,000 in 2007.

Although 75 percent reported some business income, how many of these high earners are what most people think of as small business owners? How many of these wealthy taxpayers report that most of their income was from this business-type income? The Tax Policy Center analyzed IRS data looking to see how many wealthy tax filers could say that half of their income or more came from business income. The center found that, among the wealthiest filers -- the top 1 percent -- only 32.5 percent earned more than half their income from business-type income. The percentages for non-wage income were even smaller among taxpayers earning less.

Even if only 30 percent of the rich report that more than half of their income came from businesses, a higher tax on the rich would affect these businesses significantly and would have some effect on those businesses owned or run by the other 40 percent of the rich reporting business income.

The United States has about 1.5 million small businesses, and the vast majority of business owners earn modest incomes. According to the Joint Tax Committee, only 750,000 people – about 3 percent of those who report positive net business income – would be affected by the higher rates. But, the Tax Foundation estimates that the average tax return with business income will report adjusted gross income of $948,414 in 2011. This average-income business could face a total tax increase of $66,979, bringing their federal tax burden to more than $293,000. Higher overhead costs lead to lower profits, fewer dollars for reinvestment and less money for payroll. Thus, millions of workers could be harmed by tax hikes aimed at the rich.

Rather than talk about an increase in income taxes on any group, we should be talking about eliminating the income tax and replacing it with a consumption tax. A tax creates a distortion of resources relative to the absence of a tax. If a tax on income reduces the incentive to create income, that is a dramatic deterrent to a growing economy. A tax on consumption alters the decision to consume or to save. Moreover, the tax is imposed more on those who consume than those who save and more on those who consume more. So in this sense a tax on the rich can be imposed. The rich are likely to spend more.

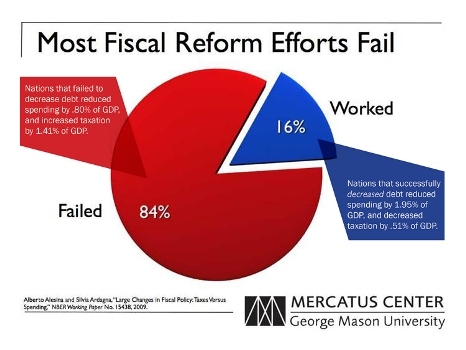

No matter what type of tax system is used, it has to be remembered that if government can increase revenues and spend more it will. There has to be a limit on the size of government. Government must be reduced until it does only what it was defined to do in the U.S. Constitution.