Sunday, June 27, 2010

10 Lessons from the recent meltdown

All 10 lessons are worth a look - click title to read his Atlantic article.

1. The American Century isn’t over.

2. Liberal capitalism works.

3. The rogue states are parasites.

4. The old left is dead.

6. That goes double for financial markets.

7. The Battle of Financial Markets is over; the Battle of State Finance has begun.

8. The demographic crunch time is here.

9. Culture matters.

10. The politicization of economic governance is dangerous business.

Saturday, June 26, 2010

The Moral Case for the Free Market

Friday, June 25, 2010

A little bit of good news

A great read - I wonder if yesterday's post may account for the study conclusion?

Thursday, June 24, 2010

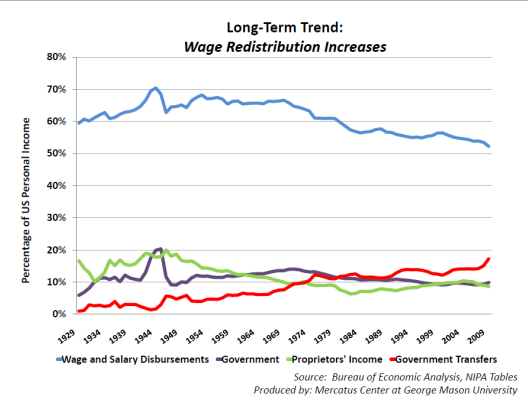

Wage Redistribution Increases

Toward Sustainable Capitalism

In today's (6/24/2010) Wall Street Journal Al Gore says the following:There are several well understood advantages inherent in capitalism that make it superior to any other system for organizing economic activity. It has proven to be far more efficient in the allocation of resources and the matching of supply with demand, far more effective at wealth creation, and far more conducive to high levels of freedom and political self-governance. At the most basic level, however, capitalism has become the world's economic ideology of choice primarily because it demonstrably unlocks a higher fraction of the human potential with ubiquitous organic incentives that reward hard work, ingenuity and innovation.

For these reasons and others, markets lie at the foundation of every successful economy. Yet the recent crisis in global markets (following other significant market dislocations in 1994, 1997, 1998 and in 2000-2001), has shaken the world's confidence in the way modern capitalism is now operating.

Moreover, glaring and worsening systemic failures—such as growing income inequality, high levels of unemployment, public and private indebtedness, chronic under-investment in education and public health, persistent extreme poverty in developing nations and, most importantly, the reckless inattention to the worsening climate crisis—are among the factors that have led many to ask: What type of capitalism will maximize sustainable economic growth? At the very least, the last decade has clearly demonstrated that free and unfettered markets, as they are currently operating, have simply not been delivering optimal long-term results.

The last sentence "At the very least..." telling us that free and unfettered markets do not work or have not been working. This is such a silly statement -- when and where have we seen "free and unfettered markets"? The financial markets are highly regulated and the problems that have arisen there during the past decade all stem from government, not free markets. The oil market is highly regulated. The BP oil disaster is the only such event in hundreds of thousands of wells. Morever, as stated in previous posts, BP was drilling 50 miles out to sea because of government restrictions and a liability cap of $75 million implemented by government.

Gore goes on to define the type of capitalism he supports:

Sustainable capitalism seeks to maximize long-term value creation. It explicitly integrates environmental, social and governance (ESG) factors into strategy, the measurement of outputs, and the assessment of both risks and opportunities. Sustainable capitalism challenges us to generate financial return in a long-term and responsible manner.

He proposes to get to sustainable capitalism by the proper use of incentives.

Incentive structures should also reflect more complete measures of performance. For example, increasingly, best practice companies are explicitly including environmental sustainability, customer satisfaction, employee morale and workplace safety in their incentive schemes. These companies understand that these considerations drive long-term financial performance. We also feel strongly that if asset owners want their asset managers to consider ESG factors in investment decisions, then they should include these factors in evaluating, measuring and rewarding performance.

What Gore is proposing is often called corporate social responsibility or CSR. CSR refers to the idea that firms have a responsibility to anyone affected by the firms’ actions, its stakeholders, rather than just its shareholders. CSR has become such an important political entity that may firms attempt to use their expenditures on the stakeholders as good business strategy. What follows are CSR reports taken from the annual reports of three large U.S. companies.

Starbucks -- Doing Business in a Different Way Contributing positively to our communities and environment is so important to Starbucks that it’s one of the six guiding principles of our mission statement. We work together on a daily basis with partners (employees), suppliers and farmers to help create a more sustainable approach to high-quality coffee production, to help build stronger local communities, to minimize our environmental footprint and to be responsive to our customers’ health and wellness needs.

FedEx -- FedEx cares about the communities in which we live and work. We are dedicated to effective corporate citizenship, leading the way in charitable giving, corporate governance and a commitment to the environment.

Gap -- At Gap Inc., we believe we should go beyond the basics of ethical business practices and embrace our responsibility to people and to the planet. We believe this brings sustained, collective value to our shareholders, our employees, our customers and society

A manager has to make all decisions so as to increase the long run market value of the firm, that is, the sum of the value of all financial claims on the firm, or else the manager will be replaced. If a firm creates an output that consumers value more than they value the inputs that went into creating that output, then society has gained from the output and the company earns profits.

Firms have to respond to whatever issues consumers think are important and are willing to allocate their resources to. It must entice consumers to purchase its goods and services. If a firm is viewed as unethical or a bad citizen, and consumers refuse to do business with the firm as a result, then the firm has to change its ways or go out of business. If consumers think an action deserves to have resources allocated to it and are willing to pay for that allocation, the company responds. A company’s resources have to be managed in such a way as to make them worth more than they would be if managed in any other way or by any other firm. In other words, a firm must maximize the value it adds to resources. If it does not, the resources will be reallocated to other, more valuable uses. A firm has to first and foremost pay attention to its shareholders. If allocating resources to the environment or to income equality or whatever increases the value of the firm then that is where resources should be allocated. But, if such an allocationg reduces the value of the firm, then the firm is being told that the allocation is a cost to society.

In a free market, managers have to respond to all stakeholders in the following way: spend an additional dollar of resources to satisfy the desires of each constituency as long as consumers value the result at more than a dollar. Coercing firms to allocate resources to certain unprofitable activities is a cost to society not a benefit. Sustainable capitalism should be defined as the freest and most unfettered markets possible.

Saturday, June 19, 2010

Taxes, Regime Uncertainty, and What's Next

The Wall Street Journal reported June 19, 2010 that Japan was considering a ten percent cut in its corporate tax rate. That will leave the United States as the highest taxing developed nation. And, taxes will increase again January 1 when the Bush tax cuts are allowed to expire. So here we have the highest taxes at the same time the Administration is stealing money from BP and threatening any company that thinks about doing business in the U.S. Why would anyone invest in the U.S.? We are looking at a real disaster -- a stumbling economy, a huge stimulus that does not stimulate but instead increases debt to unheard of levels, increased taxes, and rising unfunded liabilities. The unfunded liabitilies are now estimated to exceed $130 trillion. How do we get out of this? Either a huge inflation must occur, a long term recession/depression must occur, or a huge reduction in benefits to entitlements must occur, or some combination of all of these has to occur. The only other option is for the U.S. to declare bankruptcy, sell off assets, and start all over again.

The WSJ also provided an excerpt from a forthcoming book called "Capitalism 4.0: The Birth of a New Economy in the Aftermath of Crisis" by Anatole Kaletsky, editor of the Times of London. Kaletsky argues that economists failed to either predict the crisis or provide solutions to it. He notes that "The issue at the heart of all the explanations of boom bust cycles is the unpreditability of the future.....In nonfinancial businesses market prices may move more or less rationally in response to measurable changes in supply and demand, but in financial markets, prices respond mainly to subjective expectations about events in a distant future that is often unknowable, even in a probabilistic sense. ....The role of inherent unpredictabiity in finance means that the most important prices set in financial markets -- interest rates, exchange rates, stock market values and property values -- will almost never correctly reflect conditions in the economy of today and may not create the right investment and saving incentives to keep the economy in equilibrium. ...every so often, financial markets go haywire, succumbing to the alternative excess of greed and fear that create boom bust cycles. ...There are times...when a political force from outside the market economy must intervene to moderate the financial cycle. GOVERNMENTS OR REGULATORS (caps mine) must have the power and the self confidence to second guess and override market signals." (Saturday/Sunday June 119/20, W3, WSJ)

This is one of the scariest and most depressing things I have read in quite some time. There are so many incorrect statements and concepts in this excerpt that there is not room to list them. But, to argue first that booms and busts are the result of excessive expectatons and then that market prices do not reflect the information in the economy is just ludicrous. Where do market prices come from but the interactions of buyers and sellers thus including all information and expectations such buyers and sellers bring to the interaction. The cause of booms and busts is always government intervention and monetary mismanagment. If left to their own devices, markets would solve such imbalances tyhat might arise; some people, like Keynesians might think that it takes too long for the market to do this, but it seems clear to me that evidence from the 1921 recession, the 1930-45 Great Depression, and the 2008-current, recession show that government intervention prolongs rather than shortens downturns.

I gather that the "new" model that Kaletsky is calling for is the Chinese model -- government control with some free markets. I suggest he read Mises, Hayek, and Rothbard and try to learn how markets work. Before people start clamoring to follow the Chinese model, they should learn what government intervention has ment to the creation of wealth. China looks good now because it started from such a low level. We shall see if the markets and the government collide in the near future.

Thursday, June 17, 2010

The U.S. of Venezuela

Two of the most economically illiterate events in history occurred during the past couple of days.

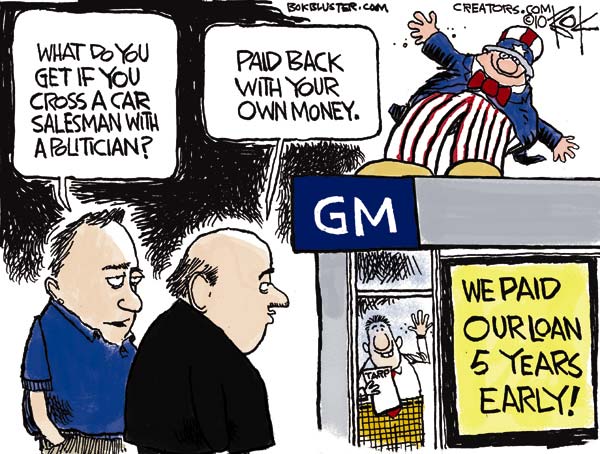

President Obama's talk to the nation sounded more like something Hugo Chavez would say than what a President of the United States would say. He extorted BP -- took $20 billion from the company, its shareholders and employees. Remember that BP drilled so far out to sea because of two reasons: first, the government would not permit any closer or on shore drilling; the federal government put a $75 million liability cap on BP. Only those two factors enticed the company into drilling. Now, the Obama administration once again changes contracts or pays no attention to private property rights. It stole money from Chrysler and gave it to the unions. Now he steals from BP and creates a slush fund to be run by government. I wonder who will receive those funds?

Did you notice that Bill Gates and Warren Buffet decided to shame all rich people into giving away all their money. Bill and Melinda Gates and Warren Buffett are launching a drive to persuade billionaires to give away the majority of their fortunes. Here is what the press had to say?

What started as a series of very private dinners last year became a public campaign Wednesday when they called on their fellow billionaires to sign a “Giving Pledge,” to donate most of their wealth to philanthropic causes of their choice.

The pledge isn’t legally binding, but they hope the effort will generate more money to address important social problems and set a standard that becomes the norm, former Gates Foundation Chief Executive Patty Stonesifer, now an adviser to the Gateses, said in an interview.

The potential for philanthropy is huge — the United States alone has at least 400 billionaires with a net worth that Forbes estimates at $1.2 trillion. If those billionaires gave the minimum pledge of half of their fortunes to charity, that would triple the current amount of charitable giving in the United States, Seattle Times reports.

Eli Broad and New York City Mayor Michael Bloomberg backed an initiative started by fellow billionaires Warren Buffett and Bill and Melinda Gates for rich Americans to give at least half of their wealth to charity.

If you have seen John Stossel's Greed, you might recall how T.J. Rogers ripped into Ted Turner for giving away $1 billion to the U.N. Rogers was absolutely correct. How can such successful peple be so economically stupid. They did more good for the world creating businesses and jobs and making profits than they could ever do giving money away. You want to help people in poor nations, then create opportunities for them. Give them money and you simply create dependence. Give them a job and you create freedom and self esteem and opportunity.

Wednesday, June 16, 2010

Democracy in Deficit

As I have continued reading, I find that the founding fathers recognized the problem of democracy and attempted to create a binding constitution that would retain limits on democracy's tendencies. But, it didn't take long for courts to overturn those restrictions and with the 17th ammendment one of the primary limits on growth of government, states' rights, was struck down.

Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide. � John Adams (1814)

• . . democratic communities have a natural taste for freedom; left to themselves, they will seek it, cherish it, and view any privation of it with regret. But for equality their passion is ardent, insatiable, incessant, invincible; they call for equality in freedom; and if they cannot obtain that, they still call for equality in slavery. De Tocqueville

Two major changes enabling democracy to lead to big government occurred in 1913. The 16th amendment to the U.S. Constitution, which permitted a federal income tax, was ratified and the Federal Reserve System was created. The Progressives had what they needed: an income tax to finance increasing government and a way to print money.

What is necessary now is to eliminate the 17th ammendment and the 16th ammendment (income tax) and to eliminate the Federal Reserve.

Tuesday, June 15, 2010

Obama and BP

He threatened to confiscate their assets and to dictate how they could behave. This frightened private capitalists -- why invest if the government is simply going to expropriate your returns? In addition to restricting the behavior of private businesses, in 1932 taxes were raised by the largest percentage in American history. State govts followed suit. The taxes, the government spending and debt added to the regime uncertainty did nothing but extend the length and depth of the depression.

Today, we are seeing an analogous but perhaps worse intervention on the part of government.Obama refers to “greedy” and “stupid” Wall Street types and he and Pelosi call insurance companies evil. But starting tonight, things are bound to get worse. President Obama is making a national speech on the BP well disaster. I suspect he is going to threaten BP, perhaps even expropriate assets as he demands they put money into a fund the government can use to compensate victims and others and not to pay a dividend and to bear higher taxes. In addition, he is likely to tax all oil compenies to create some huge special emergecy fund.

Mr Obama has been touring Mississippi, Alabama and Florida, on his fourth visit to the region since the spill. He has promised Americans living on the Gulf of Mexico that their beaches would be restored to pristine condition, vowing that he would bring full force to bear on BP to pay for the damage from oil pollution. If this Administration destroys BP and penalizes other private companies, why would any foreign firm do business in America? Why face the highest corporate taxes in the developed world and also fear your assets will be stolen by the government?

Obama said, "Beyond the risks inherent in drilling four miles beneath the surface of the Earth, our dependence on oil means that we will continue to send billions of dollars of our hard-earned wealth to other countries every month - including many in dangerous and unstable regions." "In other words, our continued dependence on fossil fuels will jeopardise our national security. It will smother our planet. And it will continue to put our economy and our environment at risk.

His remarks followed comments in which he said the ongoing oil spill would change the way the US thinks about energy forever - comparing the effect of the disaster on the environment to the way 9/11 shaped US security policy. But, he hasn't commented on the obvious that regulations forced BP and other companies 50 miles offshore and drilling miles below the sea level. Drilling on land would have been so much less expensive and so much less damaging to the environment.

There is no cost efficient energy available other than fossil fuels. The Aministration's attempt to force it to be otherwise will, as Obama said, necessarily cause electricity prices to skyrocket.

Perhaps the worst aspects of this crisis, is the Obama Administration's policy of not letting a good crisis go to waste. The Administration believes now is the time to push through the cap and trade bills and to limit what oil companies can do. It is one large step for socialism and one massive move away from liberty.

Monday, June 14, 2010

Friday, June 11, 2010

The Dead End of Contemporary Liberalism

The tag line from the initial CATO May Discussion.

The Dead End of Contemporary Liberalism

Thursday, June 10, 2010

A crisis of evasion

But I can’t help noticing an ominous correlation. The country in Europe with the biggest untaxed, or “shadow,” economy as a proportion of GDP is Greece. Next is (gulp) Italy. Then Portugal and Spain. On the chart below, in fact, the bars look unsettlingly like dominoes.

Much of the problem in these countries in Europe, in other words, is tax evasion. As the chart shows, the size of the shadow economy in Italy and Greece is much larger than in other developed countries, inside and outside the Euro area.

http://www.multiplier-effect.org/?p=75

Wednesday, June 9, 2010

Misdirected populism

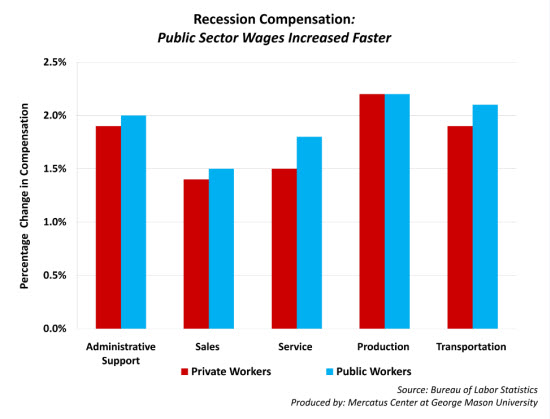

Private sector workers suffered tremendously during the past recession through job loss, reduced wages and benefits and reduced hours. This is one of the costs of a dynamic and free society - the business cycle in a market economy does trend upward over time leading to increasing standards of living. However, the fluctuations in the cycle fall heavily upon individuals - think of typewriter manufacturing workers, workers manufacturing VCRs, horse and buggy manufacturing workers, milk delivery drivers, well the list does tend to go on and on. These workers did in fact lose their jobs not to cyclical unemployment but structural unemployment. And it is good that they lost their jobs. For without the creative destruction that is embedded in the market order, free societies are doomed.

"Joseph Schumpeter (1883–1950) coined the seemingly paradoxical term “creative destruction,” and generations of economists have adopted it as a shorthand description of the free market’s messy way of delivering progress. In Capitalism, Socialism, and Democracy (1942), the Austrian economist wrote:

The opening up of new markets, foreign or domestic, and the organizational development from the craft shop to such concerns as U.S. Steel illustrate the same process of industrial mutation—if I may use that biological term—that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism. (p. 83)"

http://www.econlib.org/library/Enc/CreativeDestruction.html

Contrast this with public sector employees, during the past recession public sector jobs, wages, benefits and opportunities increased.

The anger at the private sector is misdirected and lead by elites/intellectuals and government officials making use of the tried and true populism that appeals to the masses of scared, angry and frustrated masses.

More evidence that we need economic education for Americans.

Tuesday, June 8, 2010

Government coercion

"Current policy is not having an effect of reducing drug use," Miron said, "but it's costing the public a fortune."... (1 trillion over the past 40 years)

United States repeatedly increased budgets for programs that did little to stop the flow of drugs. In 40 years, taxpayers spent more than:

_ $20 billion to fight the drug gangs in their home countries. In Colombia, for example, the United States spent more than $6 billion, while coca cultivation increased and trafficking moved to Mexico — and the violence along with it.

_ $33 billion in marketing "Just Say No"-style messages to America's youth and other prevention programs. High school students report the same rates of illegal drug use as they did in 1970, and the Centers for Disease Control and Prevention says drug overdoses have "risen steadily" since the early 1970s to more than 20,000 last year.

_ $49 billion for law enforcement along America's borders to cut off the flow of illegal drugs. This year, 25 million Americans will snort, swallow, inject and smoke illicit drugs, about 10 million more than in 1970, with the bulk of those drugs imported from Mexico.

_ $121 billion to arrest more than 37 million nonviolent drug offenders, about 10 million of them for possession of marijuana. Studies show that jail time tends to increase drug abuse.

_ $450 billion to lock those people up in federal prisons alone. Last year, half of all federal prisoners in the U.S. were serving sentences for drug offenses....

Monday, June 7, 2010

Great Society

He makes reference to the phrase "Great Society" in reference to classical liberalism or the society that emerged and evolved as a result of spontaneous order. This process is familiar to readers of Hayek and is well described in Hayek's three volume work.

I got to thinking about this month's blog discussion, in particular the role played by elites/intellectuals in shaping public perception and belief. An illustrative example is the appropriate of the phrase Great Society from Adam Smith by Lyndon Johnson to describe the welfare state of his administration.

His use of this phrase describes a society and process of interaction that is the opposite of the Adam Smith original. Yet, if anyone has heard the phrase Great Society today - what and whom do they think of?

Clearly those that are familiar with this will think of the myriad welfare programs of the Johnson administration, significantly developed and implemented during a time of war. This Orwellian use of language illustrates one of the primary methods of interventionist intellectuals in their efforts to "plan" a society toward "social justice".

On this point, Hayek writes:

There is apparently no end to the violence that will be done to language to further some ideal and the example of "social justice" [is paramount as and example] . . .It would seem as if the conviction that one is arguing in a good cause produced more sloppy thinking and event intellectual dishonesty than perhaps any other cause. (Law, Legislation and Liberty, vol. 2 page 80)

Hayek gives more credit than is earned when he offers sloppy thinking as an explanation for intellectual malfeasance in discourse. His second explanation seems more pervasive. I am thinking of the ASET book club discussion last month of Sowell's Intellectuals and Society. He provides an example of a conversation with a Clinton cabinet secretary who, when presented with his comments on video tape, asserted, that's not the way I remember it. To the public intellectual, it would seem, by any means necessary, is the governing approach.

Dan Klein writes in an important article gives background to the Great Society:

It seems to us useful to resuscitate the term "great society," meaning the extended liberal social order -- akin to Karl Popper's "Open Society." The term achieves great prominence in Hayek's trilogy, Law, Legislation and Liberty (published 1973, 1976, 1979), although Hayek moved to the term "extended society" or "extended social order" in his final work, The Fatal Conceit (1988). Hayek gives a brief history of the term "great society" in the first volume of Law, Legislation and Liberty (148). Adam Smith uses the term "great society" four times in his chapter, "Of the Order in which Societies are by Nature recommended to our Beneficence," introduced in the sixth edition of TMS in 1790 (see pp. 229, 234), and once again at page 235, and Smith used the term eight times in WN (86, 260, 421, 651, 681, 726, and 747). Walter Lippmann's statement of the liberal order, The Good Society (1937), uses "Great Society" and "Good Society" interchangeably. Lippmann uses the term freely in other works as well and presumably acquired it from Graham Wallas, who published his book entitled The Great Society in 1914.

NubCity: A Story of Handouts or Handless

How does a town become known as Nub City? Why did more than two-thirds of all loss-of-limb accident claims in the United States in the late '50s and early '60s come from the Florida Panhandle? What was the first event in the bloody chain that led a national insurance investigator to Main Street in Vernon, to sit in a parked car on a hot summer night, watching the maimed walk by in a shuddersome parade?

We have a few clues.

Vernon was cursed with a long run of misfortune in the first half of the 20th century, according to a history of the town by Mary Cathrin May. The steamboats stopped running and the sawmill closed and all the major railroads through Washington County passed the town by, even though it was the county seat, and then voters moved the county seat to Chipley, and jobs became scarce, and bright young residents left for college and never came back.

As for the Nub Club, as they would later be called, someone had to be first. His identity is lost to history, but this much we can guess. One day he took a look at his hand and he compared its future earning potential to the value of his insurance policy and he made a simple calculation.

There was an accident.

Money changed hands.

Word got around.

More accidents.

L.W. Burdeshaw, an insurance agent in Chipley, told the St. Petersburg Times in 1982 that his list of policyholders included the following: a man who sawed off his left hand at work, a man who shot off his foot while protecting chickens, a man who lost his hand while trying to shoot a hawk, a man who somehow lost two limbs in an accident involving a rifle and a tractor, and a man who bought a policy and then, less than 12 hours later, shot off his foot while aiming at a squirrel.

"There was another man who took out insurance with 28 or 38 companies," said Murray Armstrong, an insurance official for Liberty National. "He was a farmer and ordinarily drove around the farm in his stick shift pickup. This day - the day of the accident - he drove his wife's automatic transmission car and he lost his left foot. If he'd been driving his pickup, he'd have had to use that foot for the clutch. He also had a tourniquet in his pocket. We asked why he had it and he said, 'Snakes. In case of snake bite.' He'd taken out so much insurance he was paying premiums that cost more than his income. He wasn't poor, either. Middle class. He collected more than $1-million from all the companies. It was hard to make a jury believe a man would shoot off his foot."

Not that the insurance companies didn't try. According to Ken Dornstein in his book Accidentally, on Purpose: The Making of a Personal Injury Underworld in America, they hired John J. Healy, the above-mentioned investigator, to look into the accidents. He observed that Vernon's second-largest occupation seemed to be watching hound dogs mating in the town square, and that its largest was self-mutilation for monetary gain.

Nearly 50 men in Vernon and surrounding areas collected insurance for these so-called accidents. None were convicted of fraud. But the increased scrutiny - along with some companies' refusal to sell any more policies in that area - brought an end to the maimings.

Sunday, June 6, 2010

5 economic lessons from Haiti

1. Economies of scale can have a large impact even on micro-entrepreneurs.

2. Markets outperform governments in the delivery of services.

3. Economic growth is the fundamental requirement for safe and affordable buildings.

4. Cultural attitudes can help or hinder post-disaster recovery — and economic growth in general.

5. Non-profit disaster relief organizations can offer impressive strengths — and a few weaknesses.

Murphy’s conclusions:

“In my brief time in Haiti, I saw the laws of economics at work. Entrepreneurs rushed to satisfy customers, as proven by the owners of motorcycles who suddenly became taxi drivers after the roads were filled with rubble. Government, in contrast, completely failed to deliver promised services to the people. I was pleasantly surprised to see that the ‘nongovernmental organizations,’ at least the one I worked for, were filled with some of the most interesting people I have ever met.

“Although outsiders can definitely provide emergency relief, and even long-term advice, ultimately Haiti will remain mired in poverty so long as the majority retains their current hostility to open competition and commerce.”

Online course from Mises Institute

Principles P600 — with Peter G. Klein

COST: $255

LENGTH: 9 WEEKS

DATES: JUNE 7, 2010 - AUGUST 7, 2010

Entrepreneurship courses, programs, and activities are springing up not only in business schools, but also in colleges of arts and sciences, engineering, education, social work, and even fine arts. Surprisingly, however, while the entrepreneur is fundamentally an economic agent—the “driving force of the market,” in Mises’s phrase—modern economics maintains an ambivalent relationship with entrepreneurship. Klein’s course, based on his new book, sorts it all out toward the goal of a realistic understanding.

While solidly grounded in Austrian and neoclassical theory, the course emphasizes applications to real-world business problems and implications for current (or budding) entrepreneurs, managers, and concerned citizens.

There are no formal prerequisites other than intellectual curiosity and a willingness to learn. The course is designed at the undergraduate/MBA level, though graduate students, executives, and other professionals are welcomed.

Weekly Topics:

Concepts of Entrepreneurship

Production and Cost

The Theory of the Firm: Introduction

The Boundaries of the Firm

Organizational Design

Corporate Governance and Corporate Control

The Corporation and the State

Saturday, June 5, 2010

Free Market vs Keynesianism

You can see the division among economists in the following remark by Paul Samuelson.

“And today we see how utterly mistaken was the Milton Friedman notion that a market system can regulate itself. We see how silly the Ronald Reagan slogan was that government is the problem, not the solution. This prevailing ideology of the last few decades has now been reversed. Everyone understands now, on the contrary, that there can be no solution without government.”

The market system is generally the most efficient allocation system—it best satisfies people’s wants and needs and raises their standards of living. Without anyone dictating what buyers and sellers do, the market determines a price for each traded good at which the quantities that people are willing and able to sell are equal to the quantities that people are willing and able to buy. Day in and day out, the market system induces people to employ their talents and resources where they have the highest value. People do not have to be fooled, cajoled, or forced to do their parts in the market system. Instead, they pursue their own self-interests and, in so doing, generate the most good for society.

Firms acquire resources and then organize and coordinate the resources to create and offer for sale various goods and services. The value that consumers place on these goods and services must be more than the value they place on the individual resources alone or else the firm will cease to exist. When a firm’s goods and services have more value than the opportunity cost of the resources used to create and sell the goods and services, then rivals will begin to compete with that firm. In other words, when economic profit is negative, the firm will cease to exist; when economic profit is positive, the sharks will attack. Rivals will enter and compete. People will get the goods and services they want at the lowest possible prices and resources will be used where their value is highest.

A free, competitive market is usually illustrated as a simple downward sloping demand curve and an upward sloping supply curve. The price and quantity at which the curves intersect represent the result of competition, the price that is the lowest possible and the quantity that people want and are able to pay for. This price and quantity result from resources being used where they are most valued. If another department store could match Nordstrom’s products and service but do so at a lower price, consumers would abandon Nordstrom and shop at the other store. This would drive Nordstrom’s profits down until they were at the normal or zero economic profit level. If iPods can be replaced with another company’s MP3 at lower prices and/or higher quality, then Apple’s profit will be driven to the normal level. Thus, the intersection of demand and supply is the point where consumers are currently happy with what they are getting and prices are as low as possible.

When competition is limited and entry restricted, then the picture changes. With total entry restrictions, the entire market is converted into a single firm, the monopolist (or a cartel of firms acting as a monopolist). The firm maximizes profit by restricting quantity and raising price. If government intervenes in the fre market price and or quantity is distorted from the competitive outcome and either "too much" or "too little " is produced and consumed. Resources are misallocated. Intervening or interfering with free competitive markets harms society.

But even so, it is argued, a free market causes too many problems. For instance,if a free market is hit by a sudden reduction in demand caused by any number of things, such as speculative activities, unexpected resource changes, or some other crisis, the free market adjusts to the demand reduction by firms exiting business and price and quantity being reduced. The free market adjusts by price dropping until the demand and supply curves intersect again.

Here is the theoretical crux of the argument between free market economists and Keynesians – the speed with which the market adjusts to changes. Critics of the free market argue that the adjustment from the first equilibrium to the second takes too much time. Markets just take too long.

A slow adjustment of the market means resources will be unemployed and inventories will stock up on shelves for awhile. If demand decreases but price and quantity do not immediately follow, then a surplus will occur. If this market is wheat, then a surplus of wheat will exist; wheat will lie dying in the field. If this market is cars, then excess inventories of cars exist; cars will be piling up on dealer lots. But most importantly to market interventionists, if this market is the labor market, then there is a surplus of labor; unemployment rises.

John Maynard Keynes, the leading economist of the 1930s, captured this criticism of free markets with the following statement:"The long run is a misleading guide to current affairs. In the long run we are all dead." Tract on Monetary Reform (1923) Ch. 3.

Free market economists argue that intervening in free markets will make matters worse than just letting the free market adjust. Under this view, when something like the Great Depression occurred in 1930 or when the financial collapse in 2006-08 occurred, the free market response would be to do nothing - because in the long run the markets would solve the problem, the price of labor would fall, more firms would hire, people would return to work, and the economy would return to full employment.

Keynes said this was madness - in the depth of a recession, why not try to do something about it, rather than leave it to 'market forces'. In the long run the recession may end but the long run could be 10, 15 or more years. Keynes wanted to try and solve the depression now rather than wait for 10 or 15 years or however, long the 'longrun' was.

This viewpoint is the basis of many of the arguments between free market economists and the Keynesian or non-free market economists. "It simply takes too long for the market to work things out. People, central planners, and governments can do it better."

The counter to this argument is that while we might be dead in the long run, our children and grandchildren won’t be. So we should do what is best for the economy in the long run and that is leave markets alone. By intervening in free markets, inefficiencies arise that slow the growth of the economy and harm future generations. In the end, intervening in the functioning of free markets just makes the situation worse and creates additional problems.

But there is more to the story than this. The Keynesian solution does not even help in the short run. The GreatDepression lasted 13 or so years; the great recession of 1921 lasted two years. The difference was that the Keynesian solution was tried in the Great Depression. In 1920, nothing was done; the free market adjusted. In 2008 the free market was interfered with in a huge way with bailout, takovers, cram downs, huge expansoins of the money supply and other Keynesian policies. How effective have those Keynesian policies been to date?

Ignoring the long run is impossible. People care what happens to their children and grandchildren and the long run to someone, say Pratt, is much longer than it is to me. As a good friend of mine states, I don't even buy green bananas any more. The intergenerational robbery that has gone on with the Keynesian policies is perhaps the theft of the century.

Propaganda

30 years ago liberty and responsibility had both an eloquent and accessible spokesman in the person of Milton Friedman. We had the chance to see glimpses of his direct and clear advocacy of economic and political freedom last month on this blog in a number of youtube snippets.

Today there is no advocate with the rare combination of intellect, accessibility and good humor to advance the cause of liberty and freedom. That vacuum has been filled with a number of pundits, intelligentsia, celebrities and politicians who advocate for centralization, big government and egalitarianism. The propaganda that is generated by these interventionists receives no effective counter in the marketplace of media, ideas and discourse.

I emphasize effective because there is a great deal of very clear advocacy for liberty and freedom from organizations ranging from The Liberty Fund to CATO to the Heritage Foundation. But that advocacy has not been effective - interventionists have seized the high moral ground and, as a result, hold sway with a majority of the population.

As I continue my summer reading of deTocqueville, it is clear that the vulnerability of a free society to democracy may be impossible to overcome. If "educated" Americans - higher ed faculty, media agents, politicians all hold to an interventionist view and have effectively controlled the ideological debate via very effective propaganda then I do fear for the future of our free society.

It does speak volumes when the vast majority of my friends and family look at Sean Penn in Haiti as a exemplar of response to changing conditions.

Friday, June 4, 2010

On Intellectuals

The typical intellectual believes everything must be explainable, while the scientist knows that a great many things are not, in our present state of knowledge. The good scientist is essentially a humble person. But you already have the great difference in that respect between, say, the scientist and the engineer. The engineer is the typical rationalist, and he dislikes any- thing which he cannot explain and which he can’t see how it works. What I now call constructivism I used to call the engineering attitude of mind, because the word is very frequently used. They want to direct the economy as an engineer directs an enterprise. The whole idea of planning is essentially an engineering approach to the economic world.