Sunday, July 31, 2011

Saturday, July 30, 2011

Thursday, July 28, 2011

Unemployment

While the unemployment today is nowhere near the level of the 1930s, interventionism and acceptance of both stabilization and welfare policy has emerged and evolved over the past 60 years in such a way that the majority in the US accept and demand that the state engage in both functions.

Peter Diamond's work suggests that labor markets function are impacted by search and transaction effects that can lead to dramatic employment effects. These empirical questions are under study by labor economists and this work will undoubtedly shape the way professional economists think about both the labor market and the relationship of that market to the macroeconomy.

I do think it is clear that, even in highly flexible labor markets there are potential and actual differences between supply and demand and that, even in an age of rapid communication and information flow, there are transactions costs related to search and match. This search and match shapes both demand and supply and is only now the focus of attention by social scientists. I suppose what I am saying here is that Hayek's knowledge problem is present in the labor market.

Moreover, it is misleading to use "the" in considering labor markets. Labor is not a homogeneous imput and the demand side of this exchange is so varied that there are many markets. The professional sports market, higher education market, air conditioning repair and installation market are so different, with distinct supply and demand characteristics that they illustration another Austrian observation - the danger of aggregation.

That said, I am thinking about two bits of information in the news today. The first is the FAA funding bill which has lead to a partial layoff of these government workers and the second is the report on June 2011 unemployment.

The latter reports that the number of unemployed is approximately 14 million.

In a related story:

The total number of people receiving benefits, meanwhile, dipped to 3.7 million. That doesn't include millions of people receiving extended benefits under emergency programs enacted during the recession. All told, 7.65 million people received benefits in the week ended July 9, the latest data available.

The number of people seeking benefits remains higher than would be expected in a healthy economy.

So taking the data above as representative of what is happening in the labor market me could make the following testable observations:

1. The number of unemployed in the US is persistently high at over 14 million

2. Over 50 per cent of the persistently unemployed (7.65 million) are receiving some "benefit"

3. The number of unemployed, after declining, seems to be increasing

4. The number of unemployed receiving benefits is declining

Lets assume that observations 1 - 4 are valid.

Then there are a number of policy implications that might be drawn.

Setting aside the interventionist perspective - there are a number of articulate pundits, "economists" and politicians who are well positioned to articulate the Keynesian response to the current labor markets discontinuities.

Thinking about Diamond and the emerging work in search and matching, the evolution of unemployment "benefits" in the US and incentives I am not surprised by points 3 and 4 above.

If an unemployed person has been both long term unemployed and "benefited" long term it seems reasonable that the transactions costs of re entering the job market would be higher the longer the person has been out of the job market. (This too is testable, I would think).

So, setting aside the social safety net function of unemployment "benefits" as well as the disincentive effects it may well be that another consequence of long term unemployment "benefits" (and most observers would, I think, concur that 99 weeks of unemployment "benefit" would be long term) is to exacerbate search and match costs.

Thinking back to the persistent and significant unemployment of the 1930s, unemployment that in terms of persistence and significance was magnitudes greater than today, I am thinking of the duration. I tend to find Higgs et al argument that unemployment duration extended for well over a dozen years and the crisis of the world wide depression, war (both hot and cold), and regime change extended this duration.

So today, the US slowly emerges slowly from the 34th business cycle trough since 1857 - http://nber.org/cycles/cyclesmain.html I wonder about:

1. The public awareness regarding the relative magnitute of the recently ended recession and current recovery. Both deviated from the norm, but neither have been the most severe/slow.

2. The role played by an increasingly complex society on search/match and the role that this complexity plays in the current level of long term unemployment.

3. The role played by the accelerating pace of change on search/match and the role that this pace plays in the current level of long term unemployment. With the pace of change accelerating and the incentive for agents to incorporate this change into both operational planning (both business and individual) and strategic planning I wonder if this might act to lengthen long term unemployment due to search/match.

4. State (government policy) as a force on match/search. Beyond unemployment benefits, minimum wage, credentialing requirements and interaction with special interest groups (unions, environmental groups, nativist groups) and trade policy all act to complicate the match/search process. I am not familiar with the work of Diamond et al, but there appears to be another dimension to the role played by the state in labor markets both in the match/search area and in the stability arena.

5. Regime uncertainty. This is illustrated by the current FAA "situation". On this topic:

A partial shutdown looks increasingly likely because Congress hasn't been able to come to an agreement on legislation to extend the FAA's operating authority, which expires at midnight Friday.

Notice the terms - partial, likely, {no} agreement, expires . . . all strong indicators of uncertainty. Ironically these is a government to government interchange that impacts a small labor market. However, one is left to wonder how this influences other labor market participants who are observing this and other actions by the government that impact the labor markets in the US.

On point I am also thinking about the NLRB intervention in Boeing business operations.

Wednesday, July 27, 2011

The government as juggler

Smith writes about efforts by politicians to deceive the public about the true financial condition of the state:

It occasions a general and most pernicious subversion of the fortunes of private people, enriching in most cases the idle and profuse debtor at the expence of the industrious and frugal creditor, and transporting a great part of the national capital from the hands which were likely to increase and improve it to those which are likely to dissipate and destroy it. When it becomes necessary for a state to declare itself bankrupt, in the same manner as when it becomes necessary for an individual to do so, a fair, open, and avowed bankruptcy is always the measure which is both least dishonourable to the debtor and least hurtful to the creditor. The honour of a state is surely very poorly provided for when, in order to cover the disgrace of a real bankruptcy, it has recourse to a juggling trick of this kind, so easily seen through, and at the same time so extremely pernicious.

Wealth of Nations - http://www.econlib.org/cgi-bin/searchbooks.pl?searchtype=BookSearchPara&id=smWN&query=juggling

Peter Boettke makes a set of observations that I find persuasive:

Scott has already talked about this at The Economic Way of Thinking, but we should dig a bit deeper into the discussion from Smith's Wealth of Nations, Vol. 2, pp. 929-2930.

Smith argues in those pages that:

(1) when the public debt reaches a certain level, the fiscal system is threatend, but there is not a single instance where a government has paid off the debt fairly and completely;

(2) rather than pay down the debt with increased taxes, government's choose "pretended payment";

(3) the prefered method of pretend payment is repudiation through debasement of the currency;

(4) this method extends the 'calamity to a great number of other innocent people'; and

(5) rather than do the right thing -- which would be least dishonorable to the debtor, and least hurtful to the creditor -- government instead choses to engage in "juggling trick".

Should these sort of issues be on the table when discussing our current public policies -- from the financial crisis to the health care debate? I think so. Perhaps for the health of the economic system and the future of our kids and grandkids, we should take the juggling power out of the hands of our political leaders.

Well, the obvious answer to the last question is yes. The problem is how? These juggling tricks are firmly institutionalized and have tremendous support, particularly in the informal institutional matrix that supports expansive government. It is the unfortunate case that the majority in the US mistakenly believe that the government can provide ___________ (fill in the blank) and, more importantly and destructively, should provide ___________ (fill in the blank). Given the manner in which the rule of law has emerged and evolved in the US, this informal belief is reflected in the tyranny of the ignorant. That said, given the widespread control of the state by special interests, I cannot be optimistic about the ability to curtail or eliminate juggling tricks.

Gavin Kennedy goes on to confirm that the use of Smith in the contemporary analysis of public choice and public finance is appropriate:

This is a case of the appropriate use of a quotation from Adam Smith’s Wealth Of Nations because it is still relevant, as government debt has increased significantly since the 18th century – in those days debt was raised mainly to fund wars or bribe foreign powers – whereas nowadays government debts fund just about anything that modern, BIG, governments spend taxpayers’ and lenders’ money upon.

Smith wrote while governments were happily inventing new forms of raising revenue for governments from the private economy. ‘Sinking Funds’ to pay-off debt soon became sources of new funds to spend more money, not always, if ever, wisely. Then they added, on a ‘temporary’ basis, income tax , and so it has gone on and on. Today, in Britain’s case, we have ‘stealth taxes’ and ‘quantitative easing’ (printing money), and unheard of levels of debt.

Smith observed that governments managed to avoid paying back all of their debt through various “juggling tricks” (beware: another one of Smith’s metaphors!).

Congratulations to Peter Boettke for picking upon Scott's references to government debt and 'juggling tricks'.

http://adamsmithslostlegacy.blogspot.com/2009/10/another-great-smithian-metephor.html

Tuesday, July 26, 2011

The Budget Debarte

For instance, according to the Investor’s Business Daily (July 22, 2011) the Cut, Cap and Balance plan supported by the House, spends $5.8 billion less over ten years than the CBO baseline. According to the CBO baseline spending will rise from $3.6 trillion in 2012 to $5.6 trillion in 2021. That is a 4.7% average annual rise. With the Cut, Cap and Balance, spending will be $4.7 trillion in 2021. This is a 3% annual rise. Yet, Congress and the President refer to this as a drastic cut; a cut of nearly $1 trillion.

The counterargument is that the baseline projection just keeps government services the same. Yes, they cost more but the actual quality and quantity of the service remains the same. But, a cut should be a cut, not remaining the same; that is not a cut.

Another game played in this budget debate is the role of future interest payments. When a deficit plan reduces program spending or raises taxes, tit curbs the rise in government debt. Thus, there will be less interest payments on the lower debt. Congress calls this possibility lower interest payments a spending cut.

Monday, July 25, 2011

Group Moral Licensing

Group Moral Licensing

Sunday, July 24, 2011

"morally confused"

Smith outlines an ethical framework that rests upon 4 pillars - self command, beneficience, prudence and justice. As I have reflected on Smith's work, these 4 pillars seem to be a reasonable basis for morality. That said, I recognize that there are any number of other moral codes that have emerged and evolved over time. The enlightenment moral code is relative young (350+years) and other moral systems have a much longer, deeper and tested development. The Hayek in me argues that I don't get to decide which moral code is superior (and more importantly I don't have to decide) as the march of time will determine the moral code that most closely align the needs and beliefs of society.

That said, the mechanism outlined by Smith in TMS seems to hit upon the process by which moral codes (I do believe that in a diverse society multiple moral codes can emerge to support the underlying processes of change in different societies) emerge and are tested.

So, back to the 10 points that Boyes summarized yesterday. The 10th point argues for a moral confusion and, while the author of these points directs this comment to "liberal elite" I would include in this confusion "conservative elite" and most of those in our society.

This confusion is nowhere more relevant than in considering points 1 and 3, which I tend to disagree with. If one includes religion in voluntary self help groups, I wouild assert that the level of popular engagement is as high or higher than when deTocquville observed American society. This question/assertion seems to have an empirial component. I am unfamiliar with what I suspect to be a wide literature on this point.

There are many antectodal examples of current voluntary association - the Red Cross, the evangelical Christian movement, the Tea Party, NRA, AARP, Tempe Historial Society . . . but the point in my mind is clear, voluntary associations are emergent and continue to evolve, primarily outside the direct juristication of the state.

The author of the 10 points asserts:

"As the state grew, however, all these associations declined. In Western Europe, they have virtually all disappeared."

The latter observation is hyperpole and can be dismissed. The former assertion is testable and worthy of review. As I have said, I am not familiar with the literature that would address this question, but Boyes' summary has peaked my interest. Not enough to seek out the literature but to wonder.

Point 4 is an important one - The liberal welfare state makes people disdain work.

I would argue that the work/leisure tradeoff is subject to economic analysis. There is a reason one set of activities is labeled work and another set leisure. The calculus of cost benefit between the two is culturaly shaped, but that said, most humans prefer leisure to work. The connection in analyzing the welfare state is obviously the distortion to this calculation when the state increases the benefit of leisure and reduces the cost to the individual of leisure. So, while the welfare state impacts this fundamental tradeoff I see it as disingenuous to imply that the welfare state is the source of the tradeoff.

Boyes directs our attention to one view of the emergent welfare state (relatively young in terms of the march of time) and this provocative 10 point inditement provides an interesting framework to begin to think about the moral consequences of choice within a welfare state.

Returning to Smith, I would suspect that he and other enlightnement thinkers would identify secondary consequences to the expansive state that would indeed shape the evolution of moral codes.

The Theory of Moral Sentiments sees moral sentiments supported by four pillars with self command and justice the bookends.

The impact on self command of rights expansion and entitlement is complex and non ergodic (the latter term, from North's The Process of Economic Change). The movement away from individualism to collectivism which seems to be an inevitable result of the welfare state would seem to be a significant influence on self command. The process by which individuals set internal guidelines and rationalize individual decision making has been the subject of a great deal of research in economics. But we can look back to Smith who used the metaphor of the impartial spectator as a prism for understanding the evolution of self command (as well as the other 3 pillars of morality). This is a comparative process by which individuals compare their own actions (and beliefs?) to those of their fellows. It is no accident that Smith uses the phrase fellow-feeling to describe the goal of behavior. That is, our notions of self command, as well as beneficience, prudence and justice, are shaped by what we see around us.

So, as significant as is the state in this Smithian process, so are other institutions, particularly those that comprise popular culture. So, do individuals today look to Thomas Sowell or Amy Winehouse, David Hume or Lady GaGa for fellow feeling? As an aside, my wife was saddened by Winehouse's death as she is familiar with her work as an "artist". My wife had not heard of David Hume. When I attempted to outline a bit of Hume, she said, "Oh, is he like Sarah Palin?" This is a reflection not of my wife, but my considerable limitation in explication - of either Hume of Lady GaGa.

What I am asserting here is that the insitutional influence upon morality is multivaried and complex, more that merely the state influences the emergent and evolutionary process that shapes morality.

Last night Stossel touched on this process in an interview with Historian Thaddeus Russell on American military intervention and historical myths.

http://video.foxbusiness.com/v/1069985114001/freedom-pop-culture-vs-military-intervention/

Clearly the process above is a complex one, the point to be made is that there is not a single cause for changes or influences to the emergent process of morality and changes to beliefs that underlie morality.

The abstract review is, I think relevant to the consideration of the 10 provocative points summarized by Boyes. Peter J. Boettke writes of the book: An Anarchist’s Reflection on the Political Economy of Everyday Life.

"James Scott has written a detailed ethnography on the lives of the peoples of upland Southeast Asia who choose to escape oppressive government by living at the edge of their civilization. To the political economist the fascinating story told by Scott provides useful narratives in need of analytical exposition. There remains in this work a “plea for mechanism”; the mechanisms that enable social cooperation to emerge among individuals living outside the realm of state control. Social cooperation outside the formal rules of governance, nevertheless require “rules” of social intercourse, and techniques of “enforcement” to ensure the disciplining of opportunistic behavior. "

At the center of my reflection on the complex role played by the state on morality is my understanding of these rules - what Hayek called law, as opposed to legislation.

Saturday, July 23, 2011

How Liberal Policies Make Society Worse

Ten Ways Progressive Policies Harm Society's Moral Character

Tuesday, July 19, 2011

Dennis Prager

ShareThis

While liberals are certain about the moral superiority of liberal policies, the truth is that those policies actually diminish a society's moral character. Many individual liberals are fine people, but the policies they advocate tend to make a people worse. Here are 10 reasons:

1. The bigger the government, the less the citizens do for one another. If the state will take care of me and my neighbors, why should I? This is why Western Europeans, people who have lived in welfare states far longer than Americans have, give less to charity and volunteer less time to others than do Americans of the same socioeconomic status.

The greatest description of American civilization was written in the early 19th century by the Frenchman Alexis de Tocqueville. One of the differences distinguishing Americans from Europeans that he most marveled at was how much Americans -- through myriad associations -- took care of one another. Until President Franklin Roosevelt began the seemingly inexorable movement of America toward the European welfare state -- vastly expanded later by other Democratic presidents -- Americans took responsibility for one another and for themselves far more than they do today. Churches, Rotary Clubs, free-loan societies and other voluntary associations were ubiquitous. As the state grew, however, all these associations declined. In Western Europe, they have virtually all disappeared.

2. The welfare state, though often well intended, is nevertheless a Ponzi scheme. Conservatives have known this for generations. But now, any honest person must acknowledge it. The welfare state is predicated on collecting money from today's workers in order to pay for those who paid in before them. But today's workers don't have enough money to sustain the scheme, and there are too few of them to do so. As a result, virtually every welfare state in Europe, and many American states, like California, are going broke.

3. Citizens of liberal welfare states become increasingly narcissistic. The great preoccupations of vast numbers of Brits, Frenchmen, Germans and other Western Europeans are how much vacation time they will have and how early they can retire and be supported by the state.

4. The liberal welfare state makes people disdain work. Americans work considerably harder than Western Europeans, and contrary to liberal thought since Karl Marx, work builds character.

5. Nothing more guarantees the erosion of character than getting something for nothing. In the liberal welfare state, one develops an entitlement mentality -- another expression of narcissism. And the rhetoric of liberalism -- labeling each new entitlement a "right" -- reinforces this sense of entitlement.

6. The bigger the government, the more the corruption. As the famous truism goes, "Power tends to corrupt, and absolute power corrupts absolutely." Of course, big businesses are also often corrupt. But they are eventually caught or go out of business. The government cannot go out of business. And unlike corrupt governments, corrupt businesses cannot print money and thereby devalue a nation's currency, and they cannot arrest you.

7. The welfare state corrupts family life. Even many Democrats have acknowledged the destructive consequences of the welfare state on the underclass. It has rendered vast numbers of males unnecessary to females, who have looked to the state to support them and their children (and the more children, the more state support) rather than to husbands. In effect, these women took the state as their husband.

8. The welfare state inhibits the maturation of its young citizens into responsible adults. As regards men specifically, I was raised, as were all generations of American men before me, to aspire to work hard in order to marry and support a wife and children. No more. One of the reasons many single women lament the prevalence of boy-men -- men who have not grown up -- is that the liberal state has told men they don't have to support anybody. They are free to remain boys for as long as they want.

And here is an example regarding both sexes. The loudest and most sustained applause I ever heard was that of college students responding to a speech by President Barack Obama informing them that they would now be covered by their parents' health insurance policies until age 26.

9. As a result of the left's sympathetic views of pacifism and because almost no welfare state can afford a strong military, European countries rely on America to fight the world's evils and even to defend them.

10. The leftist (SET ITAL) weltanschauung (END ITAL) sees society's and the world's great battle as between rich and poor rather than between good and evil. Equality therefore trumps morality. This is what produces the morally confused liberal elites that can venerate a Cuban tyranny with its egalitarian society over a free and decent America that has greater inequality.

None of this matters to progressives. Against all this destructiveness, they will respond not with arguments to refute these consequences of the liberal welfare state, but by citing the terms "social justice" and "compassion," and by labeling their opponents "selfish" and worse.

If you want to feel good, liberalism is awesome. If you want to do good, it is largely awful.

Resource Allocation Distortions in the Great Recession: Empirical Evidence

Mario Rizzo does a wonderful job of explicating a part of what I was attempting to describe yesterday.

The clear message is, that while the ultimate impact on investment from government intervention may be unclear, what is clear is that intervention by the state will generate malinvestment.

Rizzo writes:

Two sectors that clearly expanded in a non-sustainable way were the financial sector and the construction (housing) sector. What is perhaps not fully understood is that amid the expansion of “aggregate economic activity” the expanding sectors pulled resources away from other sectors, even in absolute terms.

Boyes, correctly, focused on the second element described above - the malinvestment acted to "pull resources way from other sectors" thus reducing investment in those areas.

Boyes also implies in his analysis the long term impact of the "bust" that must inevitably follow the government generated "boom".

As we are seeing today, reduced investment may well be an unintended consequence of the government stimulated boom, not only in finance and construction, but in other sectors "favored" by the government . . . agriculture comes to mind, but perhaps the continuing government support in this area continues to prop up investment.

Friday, July 22, 2011

Further thoughts on incentives

I believe that Boyes was thinking about wealth enhancing investment in his original posting and embedded in his thinking I can see an assumption about the level of investment generated in a free market compared to the level of investment generated by a command economy.

In thinking about this comparison it is clear that, depending upon the institutional matrix of the command system the comparative investment level will be indeterminant.

I have specific examples in mind.

First, the sugar industry in the US is an excellent example of overinvestment due to government subsidy and support. Government intervention in the agricultural market has most asssuredly lead to overinvestment in land and capital devoted to agriculture, certainly more than one would expect the free market to generate.

Three of the four articles in the June 2011 Journal of Economic Literature are useful in thinking about the point the Boyes raises. Chad Syverson's piece - What Determines Productivity? is exellent reading and a great review of the challenge in determining and measuring productivity and the complexity of the relationships between the institutional framework of a society and productivity.

That said, he points out that the state can take actions to enhance productivity (clear defintion and enforcement of property rights, enforcement of contracts, independent, transparent and consistent judiciary) as well as reduce productivity.

In looking at the later, Syverson describes US government policy in the sugar industry. His discussion of the Bridgeman, Qi, Schmitz (2009) study is worth reading as it traces the impact of the 1934 Sugar Act. He writes: "This transfer scheme led ot the standard quantity distortions (more sugar beet production - more land and capital invested in sugar beet production than would be expected in the absence of government intervention) but it also distorted the incentives for efficient production." (354)

A second component of government intervention leading to excessive investment is the consistent action of the government to prevent failure of individual firms in a number of industries ranging from manufacturing to finance. This "safety net" acts to increase the level of investment found in these industries.

A common form of government intervention to "protect" US industry and thus lead to excessive investment include subsidy, other tax benefits and direct trade protection. The sugar industry in the US has enjoyed all three of these benefits and, given the world price of sugar and the relative comparative disadvantage of US sugar producers it is hard to argue that investment in this market would most certainly decline (to zero?) in the absence of the government.

Doug Barlow writes:

"The sugar program directly empowers producers to plunder consumers. Import quotas limit sugar supplies, sharply hiking prices and pushing food-makers to use high-fructose corn syrup. Explained Michael K. Wohlgenant of North Carolina State University: “Since the mid-1970s, as a result of the sugar program, the price of sugar in the United States has been almost twice as high as the price of sugar on the world market in most years. The resulting estimated costs to U.S. consumers have averaged $2.4 billion per year, and with producers benefiting by about $1.4 billion per year.”

http://blogs.forbes.com/dougbandow/2011/07/18/its-time-to-kick-farmers-off-the-federal-dole/2/

In thinking about the impact that the government has on the incentives to invest it might be useful to think about comparative advantage. The following hypothesis might be worthy of testing: If the market being intervened by the US government is one characterized by a dynamic comparative disadvantage, government action might well lead to excessive investment. The reverse might well hold in the case of a market in which the US has a comparative advantage.

Regardless of the nature of the market, distortions to investment, malinvestment (as opposed to no invesment) and time distortions to investment are inevitable consequences of government intervention.

Thursday, July 21, 2011

Incentives

"businesses have no incentive to invest in the United States"

I might extend this observation to assert that businesses do have an incentive to engage in rent seeking, a form of investment that is welfare reducing.

Given the entreprenuerial talent and spirit of those in the business community there are opportunities to "invest" in actions that "protect" specific businesses and activities. Looking at the expansion of K street lobbying activity it is clear that American business react in a predictable fashion to the growing welfare, warfare and administrative scale and scope of government intervention in US society.

So, the incentive is to not invest in productive activities, rather to engage in investing in rent seeking activities. So while net investment may actually be the same or even larger in dollar terms that decades ago, the investment in lobbying, the infrastructure of rent seeking and associated activities, the consequence is not wealth enhancing, but rather wealth destroying.

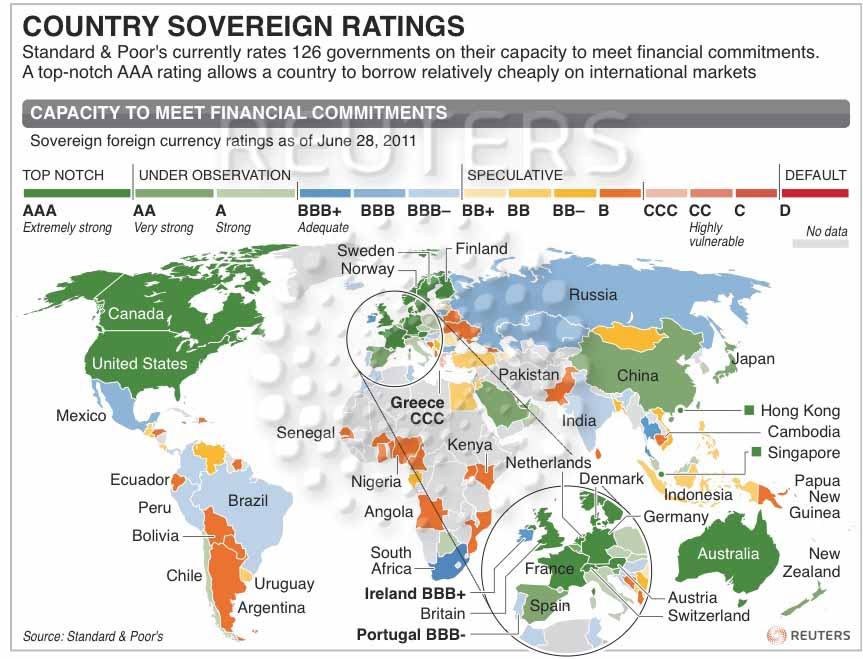

Sovereign Debt Pressure

The United States, however, is not free from this problem either. The following chart from The Economist shows “what it would take governments to reduce gross debt to 60% of GDP by 2026.”

Wednesday, July 20, 2011

Regime Uncertainty

QE1 and QE2 along with TARP, and the various other stimulus expenditures have done nothing. Why haven't these Keynesian prescriptions worked? Paul Krugman and Alan Blinder claim that the problem is that these programs were not large enough. In contrast, they should know that it is impossible to stimulate an economy when business does not want to invest and create jobs. Facing 36% corporate tax rates, double the rates in most other countries, as well as the huge additional “taxes” of Obama Health Care and the Dodd-Frank legislation, businesses have no incentive to invest in the United States.

Tyler Cowen on Greece

Well worth a read.

Tuesday, July 19, 2011

Greece: More Discussions about Debt Reduction

This remark echoed as a listened to a summary of the Pew survey on this topic. While Americans surveyed have more concern that my scientist friend over deficits and debt, they are adamant about continuing and expanding entitlement programs. When pressed *(questioned) they indicated that these social welfare programs could be funded by tax increases and, in a populist view, increasing the rate of taxation on the rich.

Greece: More Discussions about Debt Reduction

Friday, July 15, 2011

Ken Rogoff on the debt crisis and Italy

Ken Rogoff writes:

The relationship between growth, inflation and debt, no doubt, merits further study; it is a question that cannot be settled with mere rhetoric, no matter how superficially convincing.

http://www.bloomberg.com/news/2011-07-14/too-much-debt-means-economy-can-t-grow-commentary-by-reinhart-and-rogoff.html

On the news hour last night Rogoff discussed the Italian response to deficit and debt with Calvo-Platero.

This final comment is both illuminating and, reflective of an attitude that I call the Doug Flutie syndome - a last minute miracle is always in the background to "save" us.

KEN ROGOFF

I don't think the current status quo is tenable. I think that's very, very clear.

And it's not yet transparent how they're going to move ahead. So, it's a very fragile situation, even though, at the surface, it's OK. And, by the way, about the austerity package, there's a bank run danger here, that, if you lose confidence, if people lose confidence in the Italian banks, what are they going to do? That's the big risk in Europe.

RAY SUAREZ: Well, Mario, you heard Ken Rogoff describe a situation that sounded like the euro having the possibility of unraveling. Do you think that's a possibility?

MARIO CALVO-PLATERO: Well, there is lots of talk on how Europe is going to deal with this, and there is talk about a two-speed euro, a few countries with the current euro, and some other countries with a less stringent attachment to the euro.

The question here is -- as Ken was saying, is political. If Europe is able to show one single face on this issue, then it will do much better to convince the markets things are under control. I do not believe for a second that there will be a run on the Italian banks. They're relatively solid.

The saving rate in Italy is very high at the private level. The debt is very high, 120 percent of GDP, but there is a plan to reduce it, of course. So, I don't think -- I mean, you know, we have an Italian, Mario Draghi, who's going to be the next governor of the European Central Bank. I have known him for many years.

I'm sure that he will make his mission to keep the euro, maybe a little bit more flexible, but to keep it as one currency. We need large currency in this process of globalization.

And can I tell you something?

RAY SUAREZ: Got to go.

MARIO CALVO-PLATERO: If something would go wrong on the euro, I bet that China will intervene and help the euro.

Wednesday, July 13, 2011

Resolving current fiscal imbalances in the US

The current fiscal imbalance has been decades in the making. Beginning with the Great Society, politicans of both parties followed the predictable path of reaping current benefit (reelection via expansion of the social welfare state) while deferring inevitable costs related to the benefit. One might well argue that the acceleration of the imbalance took place on the Republican watch, but the real issue is, assuming sincere commitment to changing the imbalance, what actions can be taken?

I would argue that before considering scenarios for reducing the imbalance it is incumbent to keep in mind the forces that public choice reveals - politically "easy" actions will take place before politically "dangerous" actions. And secondly, it is obvious that an imbalance that accumulated over a 50 year period will not be significantly reduced in a single year or single term of Congress.

That said, I would also suggest that if I read Douglass North and his colleagues correctly, the informal institutional matrix of beliefs, norms and conventions shape the formal institutional matrix. That being the case, public policy, particularly on an issue as important as taxes, government spending and the value of the dollar cannot run contrary to public opinion.

This being the case, the vast majority of the American public supports the social welfare state as it exists in the US and would oppose significant change to social security, medicare and medicaid. The Pew Foundation survey of public opinion revealed that Americans prefer tax increases to spending cuts.

The conundrum for policy makers, interested observers and economists is what to do in the face of this constraint. If the survey is correct and is a representation of the informal institutional framework of society, efforts that conflict with this set of beliefs will be unsuccessful.

The least worse option, it seems to me, is to align federal spending and taxes rather than to use inflation to monetarize the deficit. In plan English, tax increases are preferable to inflation.

I write this not advocating tax increases, rather from my belief that there is virtually no support for the alternative - steep reductions in social security, medicare and medicaid. A back of the envelope analysis confirms that, the cuts necessary in these 3 programs to reduce the deficit significantly are so large as to both be unacceptable to the public and to be disruptive (think Greece) to social stability.

In thinking about this one might attach consequences to various future courses of action:

Scenario 1 - no meaningful action toward fiscal balance using the budget. If no significant changes are made to tax and spending at the federal level this leaves only the action of inflation to resolve the imbalance.

Scenario 2 - meaningful government spending cuts to all categories of the federal budget without a change in taxes. As Boyes points out, the regime uncertainty resulting from state action has a tendency to cast a long and dangerous shadow over government activity. Given the track record in Washington, I wonder how long this scenario would need to continue in order to overcome the uncertainty that seems institutionalized in government activity. Certainly more that one policial cycle would need to transpire to provide authentic belief by the players in the US economy - both domestic and international.

Scenario 3 - a repeat of the recent past.

I have made consist efforts to find optimism in my view of our emergent order in the US, the evolution of the government and the financial imbalances that seem to be a consequence of Leviathan seem, in the past, to have generated sufficient innovation that the resulting creative destruction is Schumpeterian rather than Marxian. That said, I wonder what the future holds.

Tuesday, July 12, 2011

Miscellaneous Crazies

The US corporate tax rate is 36%; in Canada it is 16%. The US has the highest corporate tax rate of all industrial nations. The people earning more than $200,000 pay about 70% of all income taxes in the US. So how does this comport with Obama’s claim that to increase taxes on the “rich” is only fair. We know that fairness is in the eye of the beholder. But, isn’t having all citizens put “money in the game” of paying for what the government does “fair”?

Alan Blinder in the Wall Street Journal today sounded just like what he is, a very confused Keynesian. How can the Keynesians ignore the fact that a trillion dollar stimulus policy had no effect? How can tan they ignore the fact that the Fed’s 500% increase in monetary reserves – the monetary base – has had no effect on the real economy?

Robert Higgs has demonstrated that regime uncertainty will retard economic growth. President Obama’s rhetoric has done exactly the same thing that FDR’s did, scare anyone looking at investing in the US to look elsewhere or to hoard money.

From Cafe Hayek

Monday, July 11, 2011

Sunday, July 10, 2011

Saturday, July 9, 2011

Thursday, July 7, 2011

Technology and inequality

Many commentators seem to believe that the growing gap between rich and poor is an inevitable byproduct of increasing globalization and technology. In their view, governments will need to intervene radically in markets to restore social balance.

I disagree. Yes, we need genuinely progressive tax systems, respect for workers’ rights, and generous aid policies on the part of rich countries. But the past is not necessarily prologue: given the remarkable flexibility of market forces, it would be foolish, if not dangerous, to infer rising inequality in relative incomes in the coming decades by extrapolating from recent trends.

Monday, July 4, 2011

Signaling and education

Friday, July 1, 2011

The IMF

The United States would be ready to support the extension of the European Financial Stability Facility via an extra commitment of money from the International Monetary Fund, a U.S. official told Reuters on Wednesday. “There are a lot of people talking about that. I think the European Commission has talked about that,” said the U.S. official, commenting on enlarging the 750 billion euro ($980 billion) EU/IMF European stability fund. “It is up to the Europeans. We will certainly support using the IMF in these circumstances.” “There are obviously some severe market problems,” said the official, speaking on condition of anonymity. “In May, it was Greece. This is Ireland and Portugal. If there is contagion that’s a huge problem for the global economy.”

The current quota for the United States in the IMF is 17.73 percent of the IMF budget. So if the bailout to the EU is $980 billion from IMF, then the US portion is $174 billion. This, of course, is in addition to the IMF’s other expenditures. U.S. citizens, when they are fortunate to have a job work more hours per year than any European country. Retirement age in the U.S. is about 65 while in Greece it is 50 or less. Why should U.S. taxpayers subsidize the lifestyles of the Greeks – and other European countries – when those lifestyles are what led to the problem in the first place.

Is the bailout an attempt to stop a systemic crash in the world financial system? Hardly. If Greece should default, those banks holding Greek debt will lose but that is not a huge amount. All the bailouts do is prolong moral hazard. It is time to get the U.S. out of the IMF and the UN.

Correcting market failures doesn't strangle financial innovation.

While his point about the essential nature of institutional support (formal and informal) for markets to engage in wealth enhancing exchange is dead on, I have reservations about his confidence that another government agency can accomplish much of this.

Surowiecki demonstrates a failure to apply what Bastiat articules in the seen and the unseen in failing to consider government failure and the unintended consequences of government activism.

Hayek outlined the essential function of knowledge in The Use of Knowledge in Society and the process by which knowledge is internatized seems to result when individual actors or agents use information for their own ends.

It seems the height of hubris when Surowiecki writes:

The housing bubble was a collective frenzy, but it was made much worse by the fact that millions of borrowers were making poorly informed decisions about the debt they were taking on. If people had known more, they might well have borrowed less.

It seems to me that a number of questions are sparked by this assertion rather than a convincing case for government intervention:

1. What incentives lead to the frenzy - were these incentives due to information asymnetries or ignorance or where they related to government polices, rules, and regulations.

2. Therefore, perhaps the decisions were not poorly informed, but rather quite rational and predictable given the incentive structures in place. While there is debate about the scope and breadth of government failure, it is hard to argue that there was too little government oversight and participation in this market. What many might agree on is that this government oversight and participation was ineffective and incentized a great deal of the "frenzy".