Incentives matter and in this National Affairs analysis, Daniel Disalvo provides valuable historical context, insight and information to view the institutional setting that generates public sector unionization, the consequences of this institutional development and some basis for considering future consequences of this institutional development.

Much like the farm lobby, the public union presence in our political process may be a strong ongoing institution that will continue to evolve. Public choice theory suggests that this evolution will not lead to elimination, rather

In this important analysis, Disalvo provides background that may help observers contextualize the current debate over public employmment and the unionization of public employees. Well worth a read - in a key passage the author writes:

The Trouble with Public Sector Unions

DANIEL DISALVO

When Chris Christie became New Jersey's governor in January, he wasted no time in identifying the chief perpetrators of his state's fiscal catastrophe. Facing a nearly $11 billion budget gap — as well as voters fed up with the sky-high taxes imposed on them to finance the state government's profligacy — Christie moved swiftly to take on the unions representing New Jersey's roughly 400,000 public employees.

On his first day in office, the governor signed an executive order preventing state-workers' unions from making political contributions — subjecting them to the same limits that had long applied to corporations. More recently, he has waged a protracted battle against state teachers' unions, which are seeking pay increases and free lifetime health care for their members. Recognizing the burden that such benefits would place on New Jersey's long-term finances, Christie has sought instead to impose a one-year wage freeze, to change pension rules to limit future benefits, and to require that teachers contribute a tiny fraction of their salaries to cover the costs of their health insurance — measures that, for private-sector workers, would be mostly uncontroversial.

The firestorm that these proposals have sparked demonstrates the political clout of state-workers' unions. Christie's executive order met with vicious condemnation from union leaders and the politicians aligned with them; his fight with the public-school teachers prompted the New Jersey Education Association to spend $6 million (drawn from members' dues) on anti-Christie attack ads over a two-month period. Clearly, the lesson for reform-minded politicians has been: Confront public-sector unions at your peril.

Yet confront them policymakers must. As Christie said about the duel with the NJEA, "If we don't win this fight, there's no other fight left." Melodramatic as this may sound, for many states, it is simply reality. The cost of public-sector pay and benefits (which in many cases far exceed what comparable workers earn in the private sector), combined with hundreds of billions of dollars in unfunded pension liabilities for retired government workers, are weighing down state and city budgets. And staggering as these burdens seem now, they are actually poised to grow exponentially in the years ahead. If policymakers fail to rein in this growth, a fiscal crack-up will be the inevitable result.

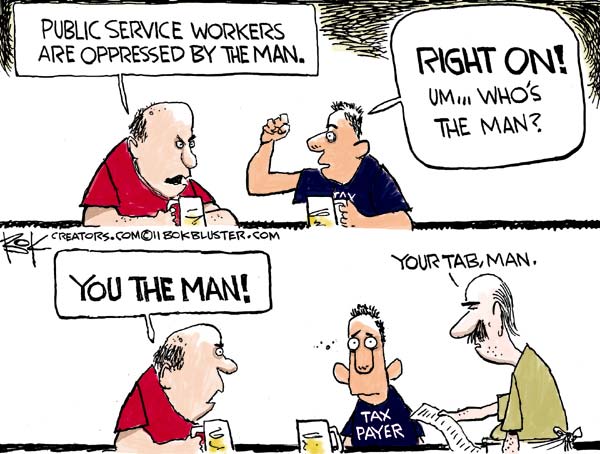

New Jersey has drawn national attention as a case study, but the same scenario is playing out in state capitals from coast to coast. New York, Michigan, California, Washington, and many other states also find themselves heavily indebted, with public-sector unions at the root of their problems. In exchange, taxpayers in these states are rewarded with larger and more expensive, yet less effective, government, and with elected officials who are afraid to cross the politically powerful unions. As the Wall Street Journal put it recently, public-sector unions "may be the single biggest problem...for the U.S. economy and small-d democratic governance." They may also be the biggest challenge facing state and local officials — a challenge that, unless economic conditions dramatically improve, will dominate the politics of the decade to come.

THE STATE OF THE UNION

Since the middle of the 20th century, organized labor in America has undergone two transformations with major implications for the nation's politics. The first is the dramatic decline in overall union membership. In 1955, organized labor represented one-third of the non-agricultural work force; today, it represents just 12.3%. The second transformation, however, is even more significant: the change in the composition of the unionized work force.

As private-sector unions have withered, public-sector unions have grown dramatically. The Bureau of Labor Statistics reports that, in 2009, for the first time ever, more public-sector employees (7.9 million) than private-sector employees (7.4 million) belonged to unions. Today, unionized workers are more likely to be teachers, librarians, trash collectors, policemen, or firefighters than they are to be carpenters, electricians, plumbers, auto workers, or coal miners.

This shift has produced a noticeable change in the demographic profile of union members; gone is the image of a union man as a beefy laborer in a hard hat and steel-toed boots. According to data from the University of Michigan's American National Election Study, in 1952, about 80% of union members were blue-collar workers, while 20% were white-collar workers; by the mid-1990s, those classified as white-collar workers gained majority status. Nor do men dominate unions any longer: In the 1950s, more than 80% of union members were men, but today there is near gender parity. Union members also have much more schooling than they once did. In 1960, more than 35% of union members had not finished high school and barely 2% had college degrees. Today, almost every union member has completed high school, and more than 25% have college degrees. The typical union member no longer lives in a major city center close to the factory; by the 1990s, union members were more likely to live in suburban than urban areas. Unions have also become multi-racial: Nearly a quarter of union members are now non-white. Unions today represent a vastly different slice of America than they did at the height of the country's manufacturing prowess.

The rise of government-worker unionism has also combined with the broader transformation of the American economy to produce a sharp divergence between public- and private-sector employment. In today's public sector, good pay, generous benefits, and job security make possible a stable middle-class existence for nearly everyone from janitors to jailors. In the private economy, meanwhile, cutthroat competition, increased income inequality, and layoffs squeeze the middle class. This discrepancy indicates how poorly the middle class has fared in recent decades in the private economy, which is home to 80% of American jobs. But it also highlights the increased benefits of government work, and shines a spotlight on the gains public-sector unions have secured for their members. Perhaps this success helps explain why, on average, 39% of state- and local-government employees belong to unions. (Differences in state and local laws of course mean that the percentage varies from state to state; New York tops the chart with roughly 70% of state employees in unions, while many Southern right-to-work states hover in the single digits.)

The emergence of powerful public-sector unions was by no means inevitable. Prior to the 1950s, as labor lawyer Ida Klaus remarked in 1965, "the subject of labor relations in public employment could not have meant less to more people, both in and out of government." To the extent that people thought about it, most politicians, labor leaders, economists, and judges opposed collective bargaining in the public sector. Even President Franklin Roosevelt, a friend of private-sector unionism, drew a line when it came to government workers: "Meticulous attention," the president insisted in 1937, "should be paid to the special relations and obligations of public servants to the public itself and to the Government....The process of collective bargaining, as usually understood, cannot be transplanted into the public service." The reason? F.D.R. believed that "[a] strike of public employees manifests nothing less than an intent on their part to obstruct the operations of government until their demands are satisfied. Such action looking toward the paralysis of government by those who have sworn to support it is unthinkable and intolerable." Roosevelt was hardly alone in holding these views, even among the champions of organized labor. Indeed, the first president of the AFL-CIO, George Meany, believed it was "impossible to bargain collectively with the government."

Courts across the nation also generally held that collective bargaining by government workers should be forbidden on the legal grounds of sovereign immunity and unconstitutional delegation of government powers. In 1943, a New York Supreme Court judge held:

To tolerate or recognize any combination of civil service employees of the government as a labor organization or union is not only incompatible with the spirit of democracy, but inconsistent with every principle upon which our government is founded. Nothing is more dangerous to public welfare than to admit that hired servants of the State can dictate to the government the hours, the wages and conditions under which they will carry on essential services vital to the welfare, safety, and security of the citizen. To admit as true that government employees have power to halt or check the functions of government unless their demands are satisfied, is to transfer to them all legislative, executive and judicial power. Nothing would be more ridiculous.

The very nature of many public services — such as policing the streets and putting out fires — gives government a monopoly or near monopoly; striking public employees could therefore hold the public hostage. As long-time New York Times labor reporter A. H. Raskin wrote in 1968: "The community cannot tolerate the notion that it is defenseless at the hands of organized workers to whom it has entrusted responsibility for essential services."

Another common objection to collective bargaining with public-employee unions was that it would mean taking some of the decision-making authority over government functions away from the people's elected representatives and transferring it to union officials, with whom the public had vested no such authority. In this view, democracy would be compromised when elected officials began sharing with union leaders the power to determine government employees' wages, benefits, and working conditions. Furthermore, collectively bargained work rules could alter what public servants did day to day in ways not condoned by either elected officials or the voting public.

Given the forces and arguments aligned against public-sector unions, what led to their enormous growth? Three conditions prepared the ground for the legal reforms that facilitated collective bargaining in the public sector (and the subsequent swelling of the ranks of unionized government employees).

The first was the weakening of party machines at the state and (especially) local levels. In many of America's large cities, the responsibility for filling government jobs fell to the party machines; turnover in government employment was therefore high, connected as it was to election results. In New York during the 1930s and '40s, for instance, the average tenure of a cop or garbage collector was five years. Another effect of the machines' influence over government hiring was political: People in patronage jobs inevitably devoted a portion of their nominal working hours to party affairs. Because government employment under the machine system was both relatively brief and partisan in nature, a culture of professionalism was never really able to take hold.

Reformers' chief weapon in the war against the machines was the enactment of civil-service laws. Such laws sought to deprive ward bosses of control over patronage, which was their lifeblood. Civic groups, the press, and public-employees' associations believed that greater professionalization of the government work force would draw in talent, increase efficiency, and reduce corruption. In the 1950s, according to historian Leo Kramer, the leadership of the American Federation of State, County, and Municipal Employees (AFSCME) "saw itself as part of a great movement to reform government," one of whose principal aims was "the extension of the merit system to all nonpolicy determining positions in all government jurisdictions."

By the end of the 1950s, reformers had put the old machines on the defensive. And professionalization had had its intended effect: In their 1963 book City Politics, Edward Banfield and James Q. Wilson found that, by 1961, 52% of cities with populations over 500,000 had placed nearly all government employees under civil-service protections.

One important consequence of civil-service reform was that, with the end of election-based turnover — and with protections against undue political interference in hiring and firing — public employees gained nearly lifetime job security. This gave workers a long-term interest in their jobs and increased their capacity to express themselves collectively, thereby helping to make the unionization of public employees possible.

The second precondition for public-sector unionization was economic and demographic change. In the post-war period, the number of government jobs grew rapidly: Between 1950 and 1976, state- and local-government employment increased from 9.1% to 15.3% of the non-agricultural work force (an increase from roughly 4 million workers to about 12 million). A large part of this spike was the result of increased demand for government services caused by the Baby Boom. Huge numbers of young people meant a greater need for workers in schools in particular; the number of Americans working as teachers, principals, and administrators thus increased dramatically. It is hardly surprising, then, that some of the first public employees to unionize (and some of the most militant) were teachers. In the 1970s in New York state alone, there were, on average, 20 teacher strikes a year.

"The third precondition (for the rapid increase in public employee unions)was the solidification of the

alliance between organized labor and the Democratic Party. Franklin Roosevelt's signing of the Wagner Act (which protected the rights of private-sector workers to organize and bargain collectively) in 1935 fully bonded labor to the Democrats; their partnership was reinforced during the fight over the Taft-Hartley Act of 1947, which was a Republican initiative to rein in union power. By mid-century, Democrats began to rely on labor unions for both funding and on-the-ground campaign organizing.

In the 1950s and '60s, according to political scientist J. David Greenstone, "labor functioned as the most important nation-wide electoral organization for the Democratic Party." As a political tag team, both Democrats and labor had an incentive to broaden the base of the labor movement — and they came to see public-sector workers as the most promising new hunting ground, especially as private-sector union membership began to decline."

As private-sector unions have withered, public-sector unions have grown dramatically. The Bureau of Labor Statistics reports that, in 2009, for the first time ever, more public-sector employees (7.9 million) than private-sector employees (7.4 million) belonged to unions. Today, unionized workers are more likely to be teachers, librarians, trash collectors, policemen, or firefighters than they are to be carpenters, electricians, plumbers, auto workers, or coal miners.

The rise of government-worker unionism has also combined with the broader transformation of the American economy to produce a sharp divergence between public- and private-sector employment. In today's public sector, good pay, generous benefits, and job security make possible a stable middle-class existence for nearly everyone from janitors to jailors. In the private economy, meanwhile, cutthroat competition, increased income inequality, and layoffs squeeze the middle class. This discrepancy indicates how poorly the middle class has fared in recent decades in the private economy, which is home to 80% of American jobs. But it also highlights the increased benefits of government work, and shines a spotlight on the gains public-sector unions have secured for their members. Perhaps this success helps explain why, on average, 39% of state- and local-government employees belong to unions. (Differences in state and local laws of course mean that the percentage varies from state to state; New York tops the chart with roughly 70% of state employees in unions, while many Southern right-to-work states hover in the single digits.)