Tuesday, April 30, 2013

Monday, April 29, 2013

Sunday, April 28, 2013

Saturday, April 27, 2013

Friday, April 26, 2013

Thursday, April 25, 2013

Edward Glaeser of Harvard University and author of The Triumph of Cities talks with EconTalk host Russ Roberts

ASET bookclub discussed Glaeser's book earlier this month.

http://www.econtalk.org/archives/2013/04/glaeser_on_citi.html

Wednesday, April 24, 2013

New Preface to Charles Kindleberger, "The World in Depression 1929-1939"

I have always thought this would be an challenging and outstanding book for ASET bookclub.

Tuesday, April 23, 2013

Wednesday, April 10, 2013

EcoDetectives: Japan meets U.S.!

How can economic institutions promote sustainable economic development? Come find out in this special workshop where Arizona educators are invited to meet and interact with 12 educators from the Japanese-US Teacher Exchange Program for Education for Sustainable Development. This fun EcoDetectives workshop presented by the MCC Center for Economic Education features active-learning lessons from ACEE, AzGA and SRP.

Participants get:

Unique networking opportunity with Educators from Japan! Hands-on Classroom-ready Lessons

Certificate for 2.5 hours professional development

Dinner

Door Prizes

$10 Registration fee. Space is limited. Register early.

Go to ACEE site to register - http://azecon.org/

Tuesday, April 9, 2013

Book recommendations by David Warsh on the FED

Warsh reviews 5 books that sound interesting - too many excellent analysis and too little time>

The Federal Reserve Board celebrates in December the hundredth anniversary of its founding. That means Americans will be going to school on books about central banking for a while longer. Thanks to the financial crisis of 2007-9, a larger niche is being carved in the civics curriculum for the government agency that oversees the intersection of the nation’s systems of money and finance.

It’s a good thing, too, for in the immediate aftermath of the financial crisis, Congress took the first steps toward creating a second, similarly elaborate regulatory system – this one intended to oversee the nation’s enormous system of medical care. Once again, a hundred years is not too soon to expect to get this one right. So the more you know about oversight of the banking system, the better you’ll understand the problems of taming the tendencies to overprovision of medical care.

Monday, April 8, 2013

The Alchemists: Three Central Bankers and a World on Fire

David Warsh thought highly of this book:

He wrote: "Irwin started covering the Federal Reserve beat for the Post in August 2007. So his book has the virtue of a fresh eye. You go along with him as he learns. The advent of central banking in seventeenth-century Sweden gets a chapter (a somewhat confusing one, in which Jimmy Stewart, from It’s a Wonderful Life, makes a guest appearance to explain fractional banking). A second chapter recalls the history of the Bank of England and Walter Bagehot’s classic work on money markets, Lombard Street. A third chapter describes the events leading up to the founding of the Fed in 1913; a fourth, the Weimar inflation of the 1920s and US and European central bankers’ failures in the early 1930s; a fifth, the post-World War II inflation and Paul Volcker’s role in ending it; a sixth, the birth of the European Monetary Union; and a seventh, the lost decade of Japan. Then comes a brisk narration of the crisis itself. At that point Irwin has become become comfortable with the story; and the second half of the book, which concerns the aftermath of the American crisis and the European second wave, adds a new and permanent angle to the story: its international dimension. Alchemy is a lousy metaphor for what central bankers do; but Irwin is a very capable reporter and the mostly successful collaboration among Fed chairman Ben Bernanke, Bank of England Governor Mervyn King and European Central Bank President Jean Claude Trichet is an important part of the story."

● The Alchemists: Three Central Bankers and a World on Fire By Neil Irwin

Q&A with author via The New York Times/Economix blog

Q: Americans generally view the financial crisis as a domestic event, and it’s already fading from memory. A central message of your book seems to be that it was primarily a European event, and it’s not over yet. A: If history teaches one thing, it is that when a severe global financial panic sets in, it can easily bend and warp and metastasize. That’s how what we once quaintly called the subprime crisis came to have such varied effects as banking collapses in Iceland and Ireland and Cyprus, a lost decade for the British economy, and a series of events that nearly unraveled 60 years of progress toward a united and peaceful Europe. At its worst, those types of unpredictable domino effects can lead to some very bad places, of which the Great Depression and World War II are the prime examples. Fortunately nothing nearly that bad has happened this time. But as catastrophic as the 2008 experience was for the U.S. economy and millions of Americans, it was closer to the start of the crisis than the end.

Friday, April 5, 2013

ASET book club

For future book clubs and dates for meeting read below and hit reply all with a preference for our next book and the date of a summer meeting. I will collect responses and sent out an e mail next month indicating a date during the summer with a title. If I don't hear from anyone, plan on our next meeting - Thursday Sept. 26th to read the first half of The Righteous Mind by Haidt.

We left out discussion without selecting a book for our next discussion nor a date.

Our first book discussion for fall is tentatively scheduled for Thursday September 26th. Stay tuned for further details

If you would like to get together over the summer for a summer book club hit reply all and suggest a date and book title.

Al suggested our Sept. discussion focus on the first half of The Righteous Mind by Haidt.

Click here for Al's comments

http://libertyandresponsibility.blogspot.com/2013/03/book-recommendation.html

Debbie indicated she had been reading about North Korea.

Bill Baumol's book on The Cost Disease (Kathy Ratte suggestion - we might save this for an Oct. meeting if Kathy comes to town again with the FTE).

http://libertyandresponsibility.blogspot.com/2013/01/the-cost-disease.html

The Economist Notable Books

http://www.economist.com/node/21541386

Other titles suggested by members - this contains Boyes' suggestion of The Currency Wars http://libertyandresponsibility.blogspot.com/2012/11/2013-aset-bookclub-dates-and-books.html

Wednesday, April 3, 2013

Possible book titles for book club

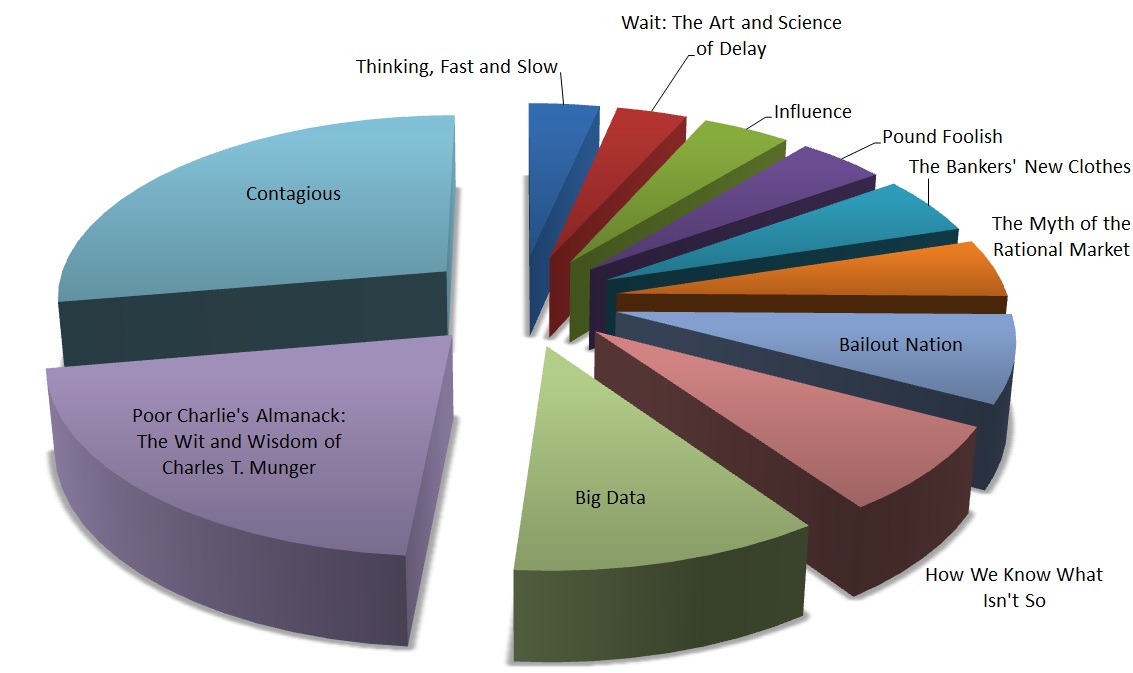

http://www.ritholtz.com/blog/2013/04/books-bought-by-big-picture-readers-march-2013/

Once again, its time to peruse the data to see which books TBP readers bought last month via Amazon’s magic embed code.

These were the most popular TBP books for March:

• The Fortune Sellers: The Big Business of Buying and Selling Predictions (William A. Sherden)

• Wait: The Art and Science of Delay (Frank Partnoy)

• Bailout Nation (Barry Ritholtz)

• How We Know What Isn’t So: The Fallibility of Human Reason in Everyday Life (Thomas Gilovich)

• The Art of Contrary Thinking (Humphrey B. Neill)

• The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall Street (Justin Fox)

• Thinking, Fast and Slow (Daniel Kahneman)

• How Music Works (David Byrne)

• The Dow Jones averages, 1885-1980 (Phyllis S. Pierce)

Tuesday, April 2, 2013

Thinking about Ed Glaeser and the Triumph of the City

Forbes on the 20 fastest growing cities in the US

Monday, April 1, 2013

Ed Glaeser's AEA presentation

This was given by Edward Glaeser, he of the recent book on how great cities are for productivity and economic growth. His topic was “A Nation of Gamblers: Real Estate Bubbles and America’s Urban History.” He began by quoting Richard T. Ely identifying real estate as the best area for investment. He went on to describe 9 episodes of urban real-estate bubbles in the U.S. – including upstate New York, Alabama, Iowa, Chicago, New York City, and California. Each bubble was driven by land prices, combined with expectations of future population growth. In some cases, building skyscrapers ended the bubble; in others, expected population surges failed to materialize. (Expectations of residents of Los Angeles in 1988 were that housing prices would rise by 14.2% per year every year.) In yet other cases, rising interest rates bankrupted speculators.

His bottom line was that real-estate bubbles have been a constant feature of American life. Contradicting Reinhart and Rogoff, however, he thought that this time was different – it was national and not confined to a single geographic area. This was partly the result of very low interest rates after 2002, combined with sharp declines (or the complete disappearance) of down payments for urban property. Anyway, his history of bubbles will be interesting reading when the paper appears in the AER in the May 2013 issue.

Click her for the full paper - well worth a read.